Are you a Connecticut resident with one or more children ages 18 or under?

Are you a Connecticut resident with one or more children ages 18 or under? - Did you claim your children when you filed your federal tax return for 2021?

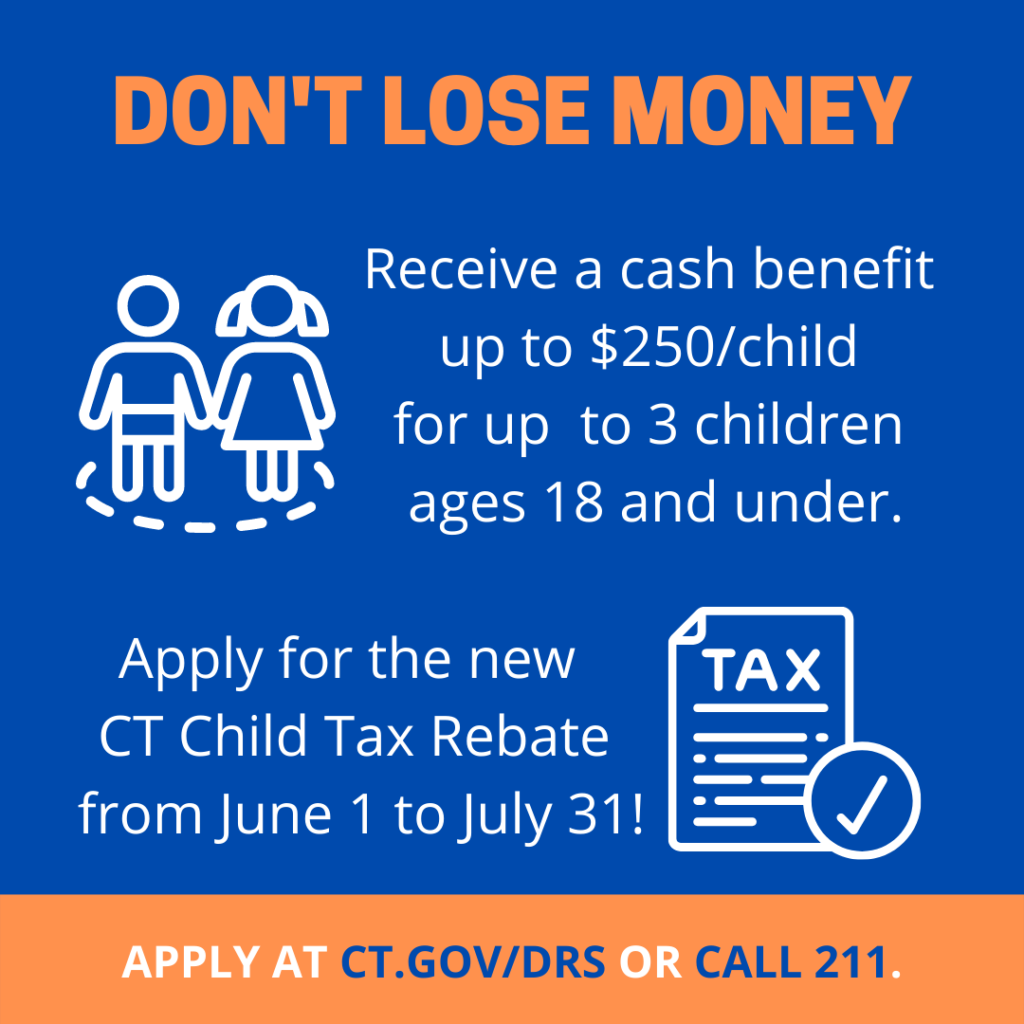

Apply for the new CT Child Tax Rebate from June 1 to July 31

Receive a cash benefit up to $250/child for up to 3 children ages 18 and under.

If you answered both questions with “YES,” you might be eligible for the Connecticut Child Tax Rebate!

The state will mail parents or guardians of children up to $250 per child (up to three children) if they apply with the Department of Revenue Services between June 1 and July 31, 2022.

It is easy to apply—you can use your computer, your tablet, or your phone.

Go to CT.GOV/DRS to learn more and to apply >

You must apply between June 1 and July 31!