Thanks to President Biden’s American Rescue Plan, there is more money available to families and/or people with low to moderate incomes. Filing your taxes is how you can claim benefits like the Child Tax Credit and the Earned Income Tax Credit. Whether or not you received stimulus checks or monthly payments in 2021, additional money may be available to you. If you won’t owe taxes, you have until October 15 to file but the sooner you file, the sooner you will receive your benefits.

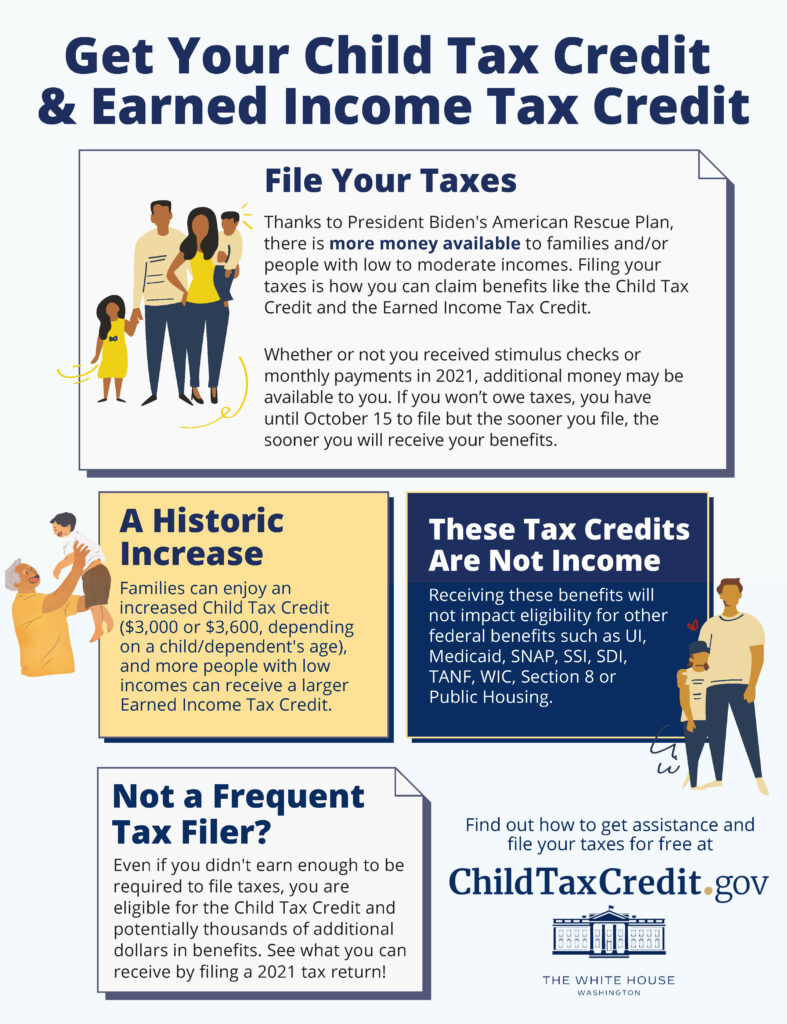

Thanks to President Biden’s American Rescue Plan, there is more money available to families and/or people with low to moderate incomes. Filing your taxes is how you can claim benefits like the Child Tax Credit and the Earned Income Tax Credit. Whether or not you received stimulus checks or monthly payments in 2021, additional money may be available to you. If you won’t owe taxes, you have until October 15 to file but the sooner you file, the sooner you will receive your benefits.A Historic Increase

Families can enjoy an Increased Child Tax Credit ($3,000 or $3,600, depending on a child/dependent’s age), and more people with low incomes can receive a larger Earned Income Tax Credit.

These Tax Credits

Are Not Income Receiving these benefits will not impact eligibility for other federal benefits such as UI, Medicaid, SNAP, SSI, SDI, TANF, WIC, Section 8 or Public Housing.

Not a Frequent Tax Filer?

Even if you didn’t earn enough to be required to file taxes, you are eligible for the Child Tax Credit and potentially thousands of additional dollars in benefits. See what you can receive by filing a 2021 tax return.

Find out how to get assistance and file your taxes for free at https://childtaxcredit.gov